Intelligent Notifications

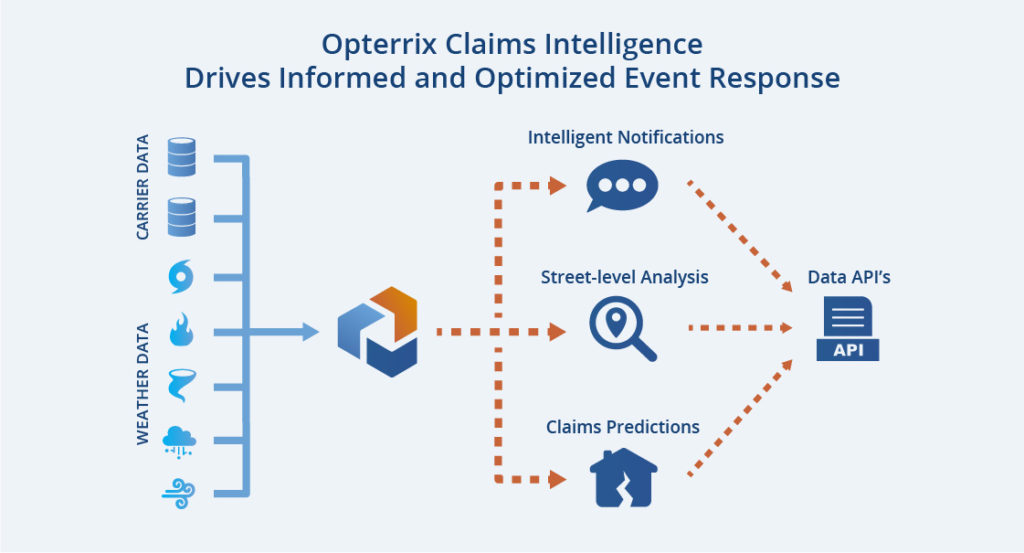

Real-time severe weather monitoring and notifications inform stakeholders the moment an event has impacted their policyholders.

Real-time severe weather monitoring and notifications inform stakeholders the moment an event has impacted their policyholders.

Post-event imagery helps clarify event severity and helps optimize response strategy.

Advanced machine learning models empower claims teams to properly allocate resources and develop a proactive claims management plan.

Opterrix empowers claims teams with proactive insights into upcoming storm activity and proprietary weather data that identifies when and where severe weather will strike.

The result is that insurers are better prepared, more engaged with customers, and empowered to drive a proactive claims strategy. Thus encouraging swift loss adjusting and reducing fraud potential.

“Opterrix has built some of the most sophisticated weather modeling and analytics capabilities in the industry. This partnership will enable us to enhance the precision and speed with which we respond to hurricanes, severe storms, wildfires, and other catastrophe events.

We have already begun leveraging Opterrix to reach out proactively to policyholders within hours of damaging hailstorms and to streamline claims processing.”

Paul VanderMarck

Chief Technology and Innovation Officer

SageSure Insurance

The Opterrix Claims solution is for a variety of insurance professionals. It's designed to help claims managers and adjusters optimize resource allocation and expedite their workflows. Additionally, risk managers can use it to monitor and manage their exposure to catastrophic events, while underwriters can leverage the claims data to inform their risk selection processes.

Opterrix uses a combination of data sources for claims analysis, including proprietary weather data and forecasts, as well as satellite and third-party data (such as aerial imagery) to assess post-event damage and property-level historical storm data. We also leverage AI and machine learning models for predictive analytics, providing valuable insights.

Opterrix utilizes AI to analyze complex weather and geospatial data, providing a significant advantage in claims management. This technology enables the platform to generate automated custom alerts when severe weather threatens a policyholder's portfolio, allowing for proactive outreach. Furthermore, our AI powers predictive models that accurately forecast potential claims volume and locations. This foresight, combined with the ability to provide near real-time intelligence, helps to streamline and expedite the entire claims processing workflow.

Yes, Opterrix uses advanced technology to assist claims teams with claims triage and prioritization. Our ability to ingest and analyze large policy, claims, and weather datasets in real-time enables our platform to help claims managers efficiently allocate resources and develop a more effective claims management strategy. This allows your event response team to focus on the most critical claims first.

Opterrix's intelligent architecture supports claims adjusters in making faster and more accurate decisions via automation and streamlined processing. Our Claims Solution facilitates rapid and precise damage assessments, increasing efficiency and enabling adjusters to handle claims more effectively, leading to quicker resolutions and improved customer satisfaction.

By enabling a faster, more proactive claims response, Opterrix helps insurers provide an elevated level of customer service. Proactively communicating with policyholders and expediting the claims life cycle can significantly increase customer satisfaction and retention rates.

By providing a clear, evidence-based view of a property's exposure and history of impactful weather events, Opterrix helps insurers identify and streamline claims processing, reducing the likelihood of fraudulent claims. The platform's real-time data and historical analysis offer a single source of truth for claims adjusters.