WEATHER & HAZARD APIs

Accurate and Dependable

Weather, Hazard, Capacity, Risk Scoring

Data

Inform and automate key decision-making throughout the insurance value chain.

Real-time & Historical Weather

Quickly gain access to real-time and historical perils such as wind, hail, precipitation, wildfire, and convective storms through high-performance APIs.

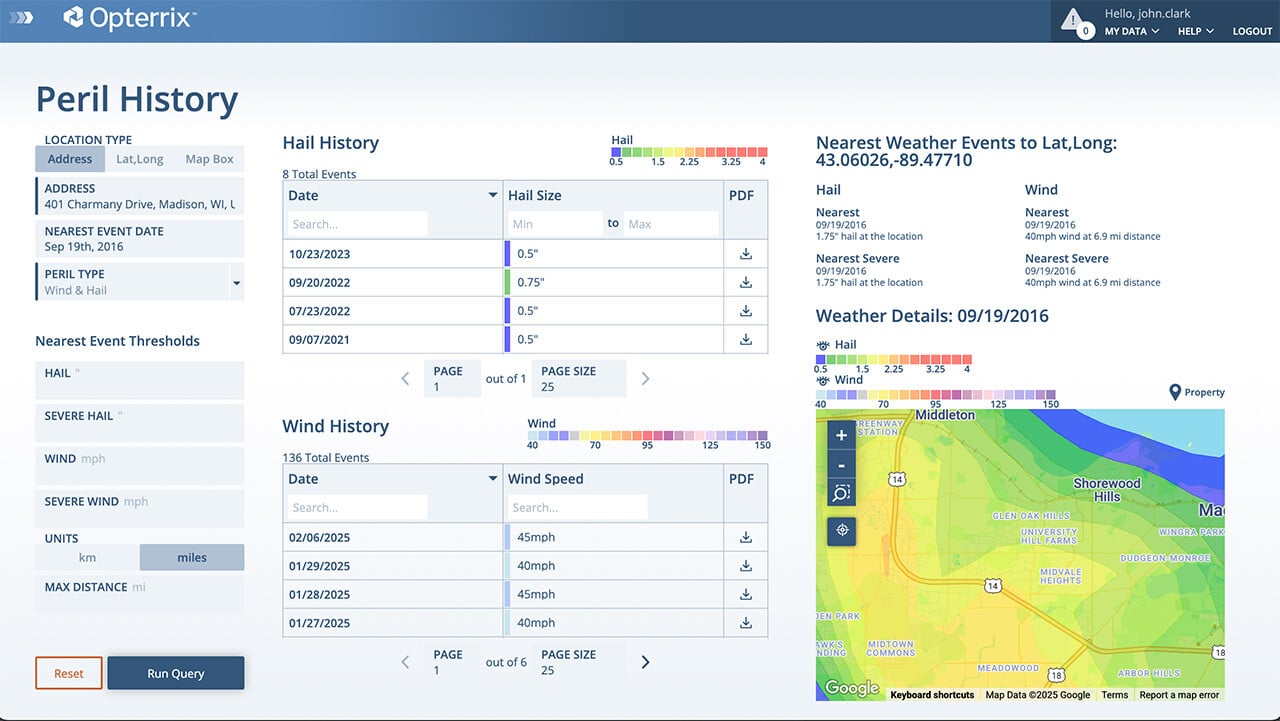

Opterrix hail data from hailstorm near Dallas, May 9, 2024.

Peril History Tool provides a comprehensive list of notable weather events at a given location.

Comprehensive Storm Event History

Address-specific historic storm assessments, including comprehensive insights into date, hazard, and event severity, are available in downloadable reports that can be automatically attached to FNOL records.

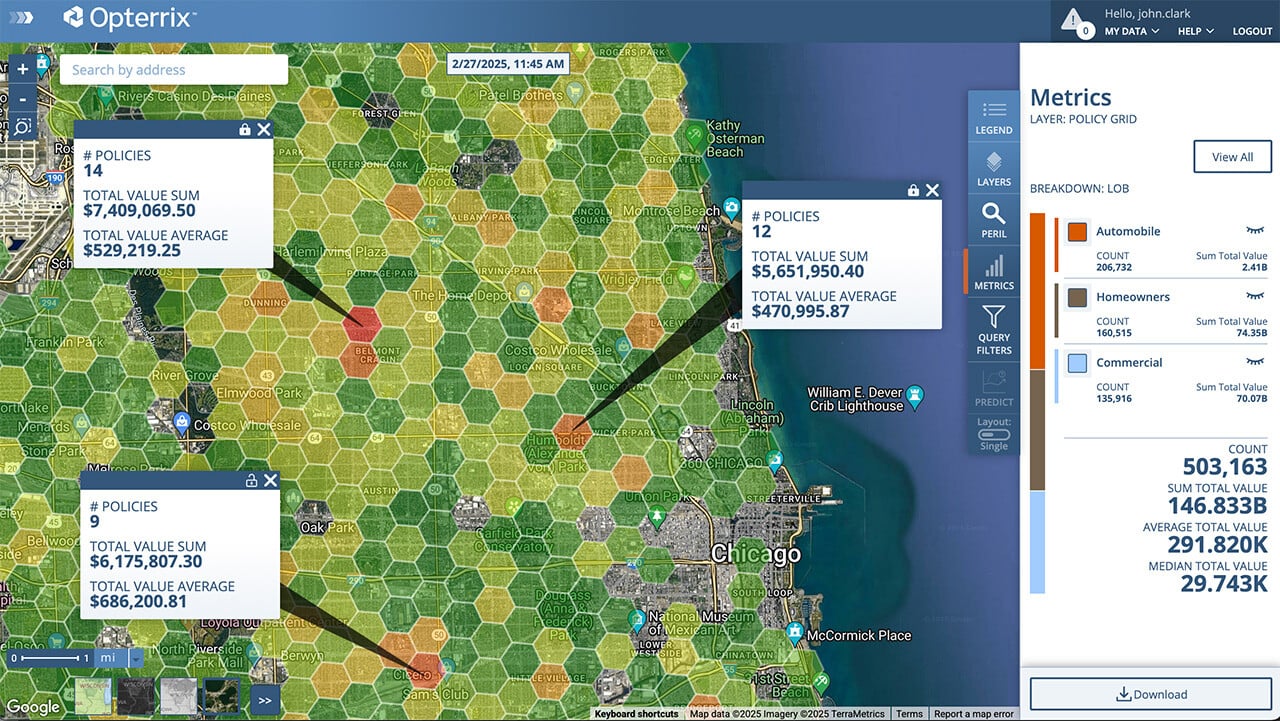

Accumulation

& Capacity Analysis

Optimize spatial accumulation, aggregation, and capacity limits at policy application and renewal.

Interactive accumulation analysis easily quantifies entire portfolios in real-time.

Real-time moratorium verifications for wildfire, flood, earthquake, and hurricane.

Moratorium Verification

Proactively prevent the binding of at-risk policies and monitor natural peril events (wildfire, hail, wind, earthquake, flood).

FAST AND RELIABLE DATA ACCESS

Insurance carriers can count on the Opterrix weather and hazard APIs for fast and accurate weather and hazard data, where and when they need it.

Fast On-Demand Access

Property-Level Resolution

99.999% Uptime

Easy Implementation

Frequently Asked Questions

-

How can Opterrix APIs help my insurance company?

Our APIs provide real-time and historical weather and hazard data, helping you automate key decisions throughout the insurance value chain. You can use our data to enhance underwriting, improve claims management, and provide better risk intelligence to your policyholders.

-

Can Opterrix APIs help streamline the claims process?

Yes, our APIs can significantly optimize your claims workflows. You can monitor and predict storm losses, get real-time notifications of events impacting policyholders, and use our data to identify concentrations of claims. This allows you to proactively allocate resources and expedite the claims response process.

-

How do Opterrix APIs assist with underwriting and risk management?

Our APIs empower enhanced underwriting by providing location-based risk scoring and a comprehensive history of primary and secondary perils. This allows for improved risk selection at the point of quote. You can also use our tools for real-time portfolio analysis, helping you manage spatial risk, optimize aggregate limits, and prevent the binding of at-risk policies with our moratorium verification service.

-

Is the data provided by Opterrix reliable and secure?

Yes. The Opterrix data platform is SOC 2 Type II compliant, ensuring your valuable data is always safe and protected. Our data is sourced from advanced meteorology, data science, and proprietary models to provide accurate and actionable insights.

-

What is the process for integrating Opterrix APIs?

Our APIs are designed for easy implementation. We offer high-performance APIs with a 99.999% uptime to ensure fast and reliable data access. We also provide documentation and support to help your development teams with a seamless integration into your existing systems.